There are still many ways to make money with NFTs in 2024. Some of these are new and have developed in recent years; others have been available ever since NFTs became popular. It’s important for those who invest in NFTs to be aware of how they work and what the risks are.

We will go over a few of the investment options out there. Keep in mind that there are no guaranteed investments that will always bring in profit and that it’s important to diversify your NFT investments for the best outcome.

What Are NFTs?

NFT is a non-fungible token that gives you ownership of a unique digital asset. Since the tokens are non-fungible, they are unique, and therefore, each one links the owner with the digital asset that they own. NFTs can be made for anything that exists as a digital asset.

Each NFT will be logged on a cryptocurrency blockchain, and it’ll keep it there until you decide to sell the asset. Even though NFTs have been around for a short period of time, they’ve already changed the nature of ownership in many industries.

Hold To Your NFTs

The simplest way to earn money from NFTs is to hold on to them and wait for their value to rise over time. This is the case with any long-term investments, and it works for both new and digital assets as well as traditional financial assets such as stocks.

Over the years, the value of NFTs and all digital assets have grown and diminished, as with any volatile asset. However, holding the NFTs has proven to be the best way to earn passive income and overcome volatility in the long run.

Create and Sell Your Own NFTs

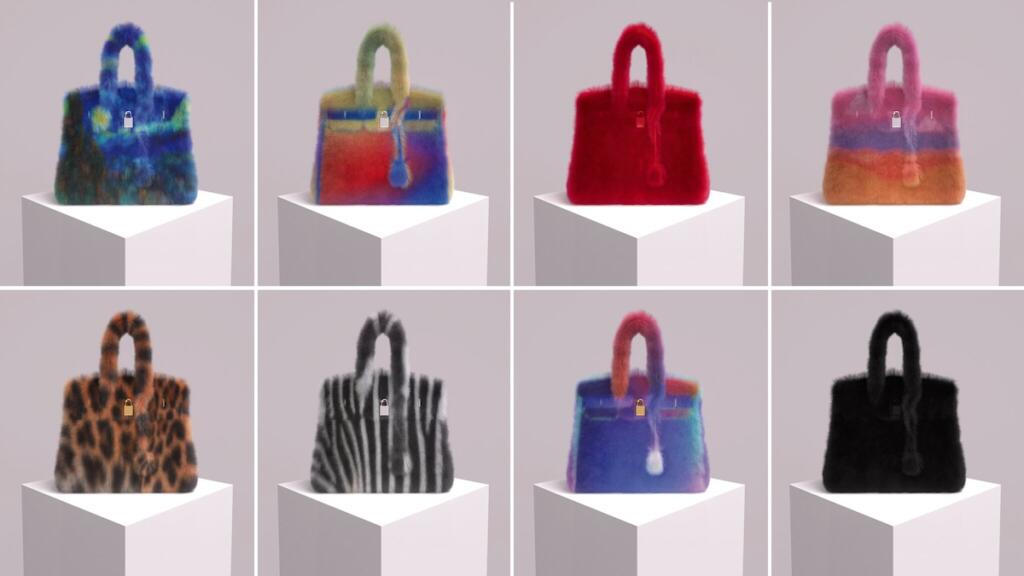

Creating your assets to sell has been the most common way to earn from NFTs ever since they first came up. NFTs encompass a wide range of digital media, including images, videos, music, 3D models, and even virtual reality experiences. Choose the one that you’re best at and most familiar with, and show everyone how creative you are.

As happens with any creative endeavor, creating something unique that resonates with the public is much harder than it seems, and it’s not easy to find an audience, even with the help of social media.

Play NFT Games

Some blockchain-based betting platforms utilize NFTs to create unique betting opportunities. Bitcoin blockchain is used to create and store NFTs, and users can place bets on dice games using NFTs representing various assets. Winnings are distributed in NFT form as well. The odds and chances of winning work the same as when betting with any other digital or traditional asset.

A good thing about dice games is that they are simple enough to earn and win big. The outcome of every dice game depends on the random number generators. This means the players shouldn’t try to chase their losses and should have a betting system in place.

Investing in NFT collections

There’s no reason to create your own NFT collections if you lack artistic sensibilities. In fact, a lot can be earned from investing in the already existing and popular NFT collections. The process for doing so is simple, but it takes time. The investors buy NFT pieces or the whole collections and sell them at a later date when their value rises.

Some well-known NFT collections include CryptoPunks, Bored Ape Yacht Club, and World of Women. The value of these collections has changed over time, but it’s gone up in the long run, making it a good long-term investment.

Secondary Markets

Secondary markets for NFTs are platforms in which the users can sell the NFTs that were previously owned. The value of NFTs changes with time, and in many cases, the owners abandon their assets when they drop the value.

The key to creating profits in this way is to keep track of the NFTs so that you can get your hands on them and notice the changes in their value. Examples of secondary market platforms include OpenSea and Nifty Gateway. The simple principle of buy low – sell high applies.

NFT Staking and Passive Income

NFTs can be used to earn passive income through the process called staking. Staking involves locking up your NFTs in a smart contract to earn rewards, typically in the form of the platform’s native cryptocurrency. As is the case with any other passive income, this option is only available to those who already have valuable NFTs that they can use for staking.

Many platforms are suitable for use this way, and they all charge their own fees and have subscription costs. Examples of NFT staking platforms include Unifty, NFT20, and Muse. There are also potential risks involved from the depreciation of NFTs.

Investing in Metaverse Assets

Metaverse is an interesting new concept that plans to take virtual reality to another level and use it to change the way internet interactions work. It hasn’t managed to take off in the way the creators have planned yet, but the potential is still there.

NFTs can be used to claim ownership of the digital assets in the Metaverse. Virtual land is a digital space within a Metaverse platform that can be bought, sold, and developed. Getting in early on this opportunity can be a way to get the best real estate early on.

NFT Trading

NFT trading is another lucrative approach to NFT markets, but it’s also the one that requires the most work and inside knowledge. Simply put, the investors buy NFTs directly from their owners and sell them directly to other individuals, making a profit in the difference in price.

As is the case with any other trading, risks are involved, and the biggest one is how to spot the NFTs that will grow in value as time goes by. Some expenses come with buying and holding NFTs until it’s time to re-sell them, so it’s not an option available to everyone.

The Risks Involved

Investors should be aware of the inherent risks of trading with NFTs before monetizing them in 2024.

· The NFT market can be highly volatile, with prices fluctuating rapidly

· There’s not enough liquidity as some NFT collections are sold very rarely.

· There’s a complexity when it comes to copyright, as NFTs are just digital images, and anyone can simply download the exact copy of the image you paid for.

· There are many frauds and scams, and it’s a new market, and many without expertise flock to it.

Conclusion

NFTs can be very lucrative, and there are many ways to earn from them. Some are simple and basically passive income, allowing those with NFTs to hold them and keep earning from their assets. Others require the investors to buy and sell the NFT at the right time. There are platforms that can help you with this, but they charge fees and subscriptions.

Investors can stack, trade, or sell NFTs at secondary markets. There’s also value in simply holding them and waiting for the price to rise, which is often known to happen with such volatile assets. Regardless of how investors choose to monetize NFTs, they should also be aware of the risks.

Author

The views and opinions expressed in this guest post are solely those of the author, and do not necessarily reflect the official policy or position of NFT News Today.