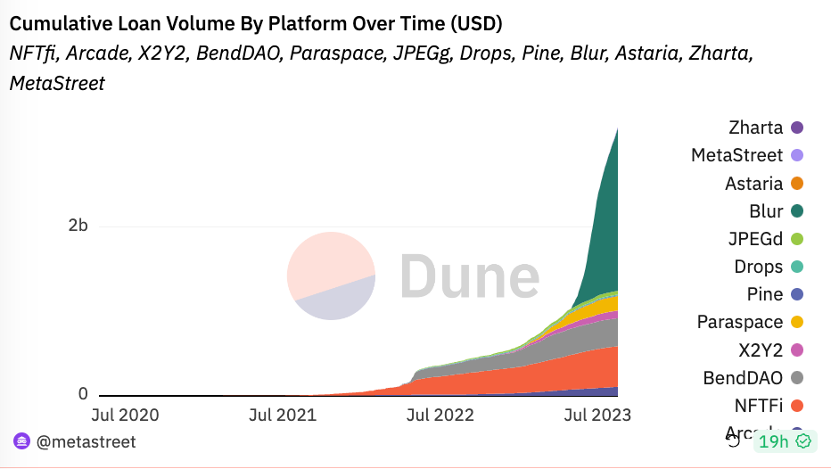

NFT lending protocols are rapidly developing with the aim to increase capital efficiency. With the increase and diversity of NFT assets, the market is continually expanding, propelling the emergence of new products and escalating market competition. At present, NFT lending is booming with smart contracts facilitating asset lending and interest rate determination, providing users with flexible borrowing options.

Some well-known NFT lending platforms such as Blend, NFTFi, and X2Fi, are continuously launching new products and improving user experience. Blend, leveraging Blur’s massive NFT market, strives for a competitive edge by waiving user fees, expanding its NFT series, and offering ETH loans with installment repayment options. In less than a month, Blend has facilitated over 157,000 ETH and 20,000 loans. NFTFi recently launched the “Earn Season 1” incentive program, where users can earn loyalty points after repaying loans. X2Y2, on the other hand, launched X2Fi and V3. X2Fi specializes in providing financial services for NFTs, while V3 is committed to offering a better borrowing experience with features such as refinance, NFT protection, borrower offer, and support for ERC-20 loans.

Source: Dune Analytics

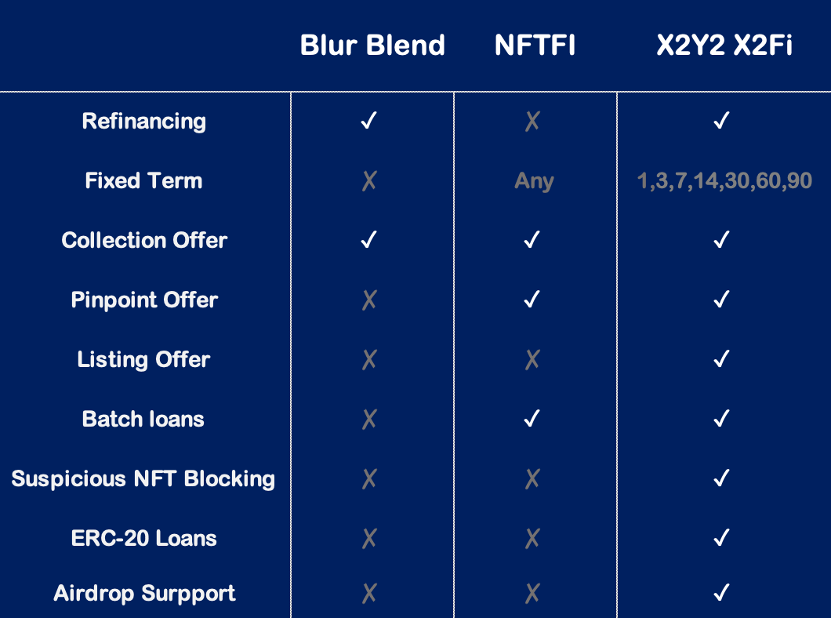

So, how are these NFT lending platforms performing? Let’s look at the main features of these three peer-to-peer lending platforms to help users make informed decisions.

Blend

Blend currently dominates the lending market with the highest cumulative lending volume, surpassing $1 billion, despite its launch in May 2023. Blend offers indefinite P2P lending terms and employs automatic debt transfer as a liquidation mechanism. Borrowers enjoy the freedom to refinance at any time, while lenders can cancel loans at their discretion. In cases where lenders cannot secure a new lender, the borrowed NFT undergoes liquidation. Blend enhances the borrowing user experience by integrating BNPL and debt transfer, creating a mechanism akin to property purchases (comprising a down payment and bank loan).

However, this flexibility has its limitations. Blend’s Collection Offer feature is platform-matched, restricting borrowers from autonomous selection. Additionally, the absence of peer-to-peer Offer functionality may pose challenges for NFT holders with specific attributes.

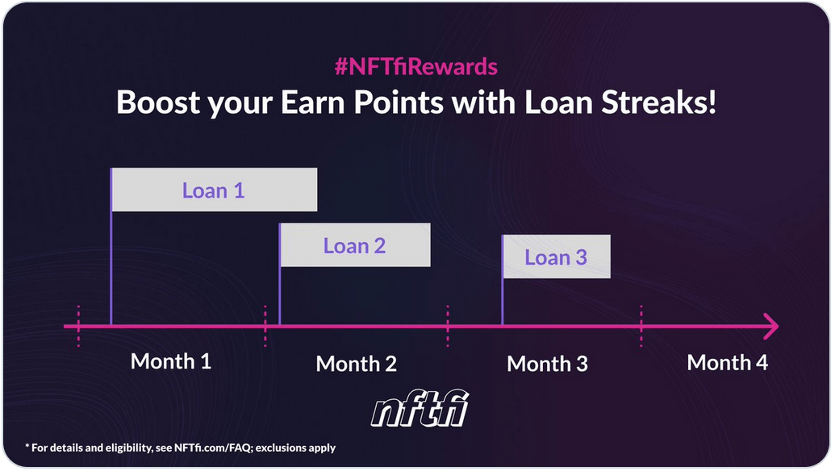

NFTFi

NFTFi operates as a peer-to-peer lending platform, entering the scene relatively early. Despite initially flying under the radar in terms of social attention, it has steadily grown its cumulative lending volume, currently ranking second at $444 million.

The recently launched “Earn Season 1” incentive program encourages users to borrow with lower APR and longer periods. This is very beneficial for borrowers, but it reduces the returns and slows down the capital flow rate for lenders. NFTFi does not have a refinance feature but does have Collection offer. Users can make a collection offer but can’t customize parameters or halt offers manually. The number of offers depends on the wallet balance, allowing for unlimited offers until the wallet balance depletes. NFTFi suggests using a separate wallet to prevent balance exhaustion for Collection Offers.

NFTFi loans have no duration limit, enabling users to set loan terms as desired, from one day to a year. The platform encourages long-term loans, with many exceeding three months, making it an attractive choice for stable NFT investments. NFTFi also offers a Bundle loans feature, allowing users to bundle NFTs and list them for matching. Before finalizing the deal, users can make unlimited adjustments, but any changes require full loan repayment and unlocking. This process hinges on both the borrower and lender agreeing on the NFT bundle’s value. If there’s a mismatch or the lender doesn’t favor an NFT within the bundle, finding a suitable offer becomes challenging and necessitates negotiation, impacting loan duration.

It’s important to note that NFTFi lacks real-time NFT filtering, has relatively weaker security measures, and doesn’t support claiming airdrops.

X2Y2

X2Fi was launched in September 2022 and has facilitated more than 16,000 loans, with a total volume exceeding $100 million. Throughout its operation, X2Fi has never had any asset theft incidents. Compared to other platforms, it provides relatively complete and comprehensive services in multiple aspects.

One notable feature of X2Fi is its Refinance functionality, allowing borrowers to adjust their loan terms during the loan period to better suit their borrowing needs. This flexibility empowers borrowers with autonomy and choice, enabling swift repayments and new loans. Moreover, X2Fi allows lenders to provide Protection for borrowers’ NFTs that are about to due to prevent borrowers from losing their NFTs due to forgetting to repay or other issues. As a result, the lender is rewarded for extending the protection and borrower’s NFT is safeguarded. X2Fi supports fixed term loans ranging from 1 to 90 days to cater to various preferences.

X2Fi offers three distinct types of loan offers:

- Collection Offer: Lenders can specify the number of offers they are willing to extend for a particular collection, streamlining the lending process and avoiding repetitive work.

- Pinpoint Offer: Lenders have the flexibility to create exclusive loan offers tailored to specific NFTs, delivering personalized services that cater to individual lender needs and boost borrowing efficiency.

- Listing Offer (initiated by borrowers): Borrowers can list their borrowing requirements and offer conditions. When a lender finds a matching listing and agrees to the terms, they can choose to match and proceed with the deal. This streamlined process significantly reduces borrowing time and enhances the liquidity of both funds and NFTs.

X2Fi’s Batch service stands apart from NFTFi’s Bundle approach. While both are peer-to-peer lending models, X2Fi groups NFTs together for borrowing, refinance, and repayment. Each loan is an independent transaction, and adjustments can be made for each NFT individually. This approach offers greater flexibility and a wider range of options for users.

X2Fi also allows users to claim airdrops. For each airdrop project, regardless of the method, X2Fi will deploy a specific airdrop contract for users to claim the airdrop. In terms of security, X2Fi implements real-time NFT filtering to protect users’ rights, ensuring the safety and trustworthiness of assets during the borrowing process.

Furthermore, X2Fi introduces an innovative lending service that converts ERC-20 tokens into NFTs, allowing users to borrow USDC. This feature enhances the liquidity of secondary mainstream coins, including SHIB, PEPE, APE, X2Y2, among others. This innovative service offers users more trading choices and flexibility.

The editor has created a visual graph highlighting the distinctions between the lending protocols.

In conclusion, these lending platforms present distinct features and attributes. X2Fi offers a comprehensive range of features and services, making it a notable player in the peer-to-peer lending space. When choosing a platform, borrowers and lenders alike should carefully assess their individual needs and risk tolerance to make an informed decision.

Author

-

Passionate Web3 and NFT explorer, navigating the complex narrative of digital assets.