Metaverse has the potential to revolutionize businesses of all stripes. Although it’s a developing industry, top metaverse platforms, including Decentraland, the Sandbox, Upland, Somnium Space, and Voxels, offer a host of opportunities to earn passive income in the metaverse.

Trailblazers are already capitalizing on these opportunities. Landowners who earn a living from rental fees in the Somnium Space, game makers of the Sandbox, enterprises that sell billboard spaces in Decentraland, and players who seize idle gameplays in the gamified metaverses are among the early adopters.

Let’s look at their stories through the lens of making passive income in the metaverse and explore approaches that are currently in use.

How to make a passive income in the Metaverse

#1 Become a metaverse landlord

Chris Bell, who owns around 100 land plots in the Somnium Space metaverse, says he earned 18,000$ by renting out properties in 2021. His strategy involves determining the property’s current value by examining the recent secondary market sales on OpenSea and renting the property to tenants for a yearly fee that is 10% of the property’s current value, targeting a 10% annual return relative to the present value of that property.

Becoming a metaverse landlord is a popular way of earning passive income in the metaverse because it creates a win-win situation, enabling tenants to build their own experiences on the rented plots, which in turn provide them with new income, as we discuss in the next section.

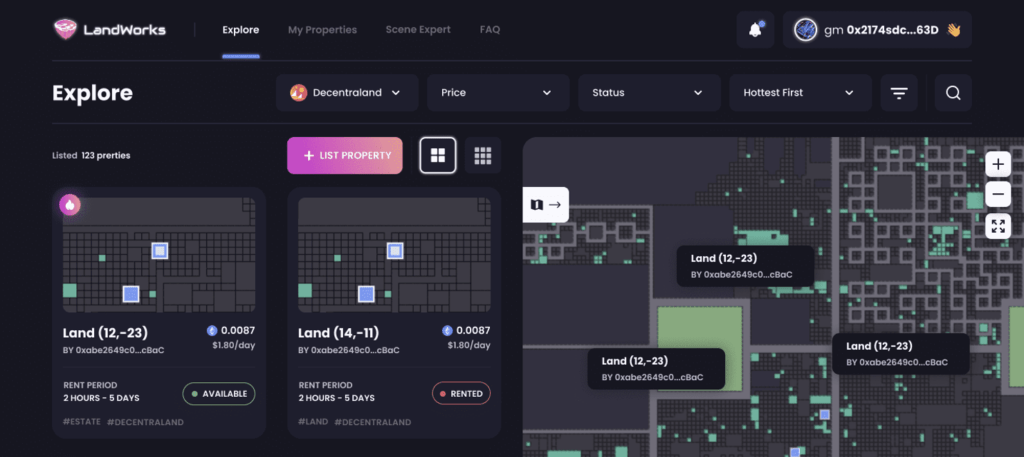

All popular metaverse projects allow leasing lands. That being said, one common drawback is the need to leave the marketplace of the metaverse in order to close the deals, which can raise security issues. That’s why new business models are built that improve the process. Consider as an example the partnership between LandWorks and the Voxels metaverse (formerly known as Cryptovoxels).

LandWorks is a permissionless lending protocol that connects landlords with tenants through a decentralized marketplace so renters can securely search Voxels’ lands. Currently, the marketplace is also integrated with Decentraland land plots.

The metaverse giant Decentraland also launched built-in land rentals to enable leasing without leaving the Decentraland marketplace. Landowners can list properties directly on-chain by approving the smart contract for the rent to let the tenant use the land on their behalf and by signing the listing prompts.

#2 Create your own metaverse experiences

Whether you are a landowner or a tenant, another way you can earn passive income in the metaverse is to create experiences on land plots and collect entry fees from visitors. Some ideas you can try are launching mini-games, putting on shows, building art galleries, dioramas, interactive tours, and building shops. You don’t have to create these experiences yourself; hiring developers and designers will pave the way for the passive route.

The ecosystem of the Sandbox is especially rich with such experiences, as the metaverse equips builders with a suite of tools that smoothes the process of creating unique experiences on virtual lands. This way, game publishers can charge players for visiting their plots and playing the games.

Additionally, the Sandbox provides two funding programs, one for the game makers and one for the creators who design game assets. As a result, many talented and experienced game artists, designers, and agencies create Sandbox experiences, and you can hire them to build custom experiences for you. You can learn more about Sandbox in this excellent article.

Other metaverse projects offer similar opportunities that you can leverage, like Blake Hotz, who hosts immersive events in the Somnium Space, which range from horror houses to try-on shopping experiences.

As Sam Huber demonstrated, expanding metaverse lands through experiences benefits the landowners also by increasing the value of the underlying plot. Huber’s company Admix – which has recently merged with Landvault – develops buildings on the lands before renting them out to clients. To give you an idea, in collaboration with L’oreal, his company built a display of oversized perfume bottles in Decentraland. As he mentioned in an interview, this is a business model with profits that can be as high as 70%.

#3 Build metaverse billboards to earn passive income in the metaverse

Just like in the real world, businesses want to advertise their services in high-traffic metaverse areas to raise brand awareness and reach prospects. So, getting paid for advertising on metaverse billboards is another way to make money while you sleep.

New-generation virtual real estate enterprises demonstrate the vast potential of metaverse billboards. They invest in attractive land plots and create ad spaces on top of them.

Decentraland Architects offers three types of billboards in Decentraland with a minimum booking period of one month, whereas Metaverse Billboards focuses on the Voxels with more than 250 billboards. Some companies, like the large-format ads provider Lemma, develop billboard solutions that merge physical and virtual worlds.

Billboards are easy to create. Individual investors – whether they are the owner or the tenant of a metaverse property, can put their investments to work by pursuing a similar route as these businesses.

Utilizing metaverse land assets to generate passive revenue expands your possibilities. However, you aren’t limited by them; here are two more options.

#4 Take advantage of staking and other interest-earning opportunities

All major metaverse projects issue their native cryptocurrencies. While Decentraland has MANA, the Sandbox has SAND, for instance. As users must spend these currencies to participate in metaverse experiences, cryptocurrencies of popular metaverse projects are in constant demand.

Consequently, they open up interest-earning opportunities through DeFi, such as staking and yield farming. As such, you can first invest in the metaverse’s native cryptocurrency and then lock the tokens within a liquidity pool for a fixed time to reap the interest at the end of the period.

Such programs are sometimes offered by the metaverses directly. For instance, in the past, Sandbox enabled SAND staking on the Polygon without having to pair it with another currency. Keeping track of the announcements of official channels of the metaverse of your interest is the way to learn about opportunities in time. Popular central exchanges also launch staking programs. Currently, Binance offers a locked staking program for SAND with up to 14.50% reward rates.

Similar programs are launched all the time in the crypto space. They aren’t bound to the cryptocurrencies either; there are opportunities for NFT staking, as well. To illustrate, in-game asset owners of the Axie Infinity – a very popular play-to-earn game with metaverse features – can stake their NFT assets and take on loans up to 30% against their value.

Another interesting case is Upland, a monopoly-like metaverse mapped to the real world. The owners of newly-minted Upland properties can earn up to an annual yield of 17% of the mint price of that property. These yields are paid in UPX – the primary currency of the metaverse, though. You must level up in the game to convert Upland yields to USD.

#5 Collect game tokens to unlock rewards

Gamified metaverses allow users to collect tokens inside the games, both fungible and non-fungible, allowing brand new ways of making passive income.

Alien Worlds has a built-in token mining process inspired by the cryptocurrency mining concept. It requires playing the game, but once you set up the necessary tools, it turns into idle gameplay with gamers waiting between sessions to accumulate the game’s native currency, Trillium (TLM), which can be swapped for other cryptocurrencies to gain real-life monetary value.

You can also benefit from widespread play-to-earn mechanisms that require very little effort, such as fusing or breeding, where you create new and improved in-game NFT items by merging two other assets. Many game metaverses, including Axie Infinity, have built similar mechanisms into their gameplays; they also allow players to sell the newly created NFTs on secondary marketplaces.

Another interesting passive income option is the NFT collaterals offered by My Neighbor Alice. Here, a percentage of the price of an NFT that a user buys goes to the collateral account of that user. When the user sells it back to the system to destroy that NFT, the amount previously locked as the collateral, is paid back to the user.

Play-to-earn endeavors never fall short of inventing unique ways of rewarding their players. You just need to devote sufficient time to a thorough exploration.

The future of passive income in the Metaverse

The metaverse of the future will be an immersive environment powered by AI, AR, VR, and hologram technologies. On the one hand, we’ll have virtual experiences that are entirely separate from the physical world, while on the other, we’ll have seamless transitions between multiple realities.

This convergence provides significant opportunities for all sorts of businesses, including novel revenue streams gained through passive income strategies. Although unexpected monetization methods ignited by emerging metaverse concepts, like teleporting, may be on the horizon, it’s also highly likely that Web2’s typical business models will progressively adapt to the metaverse, as well.

Creating an online course once and selling it several times is, for example, a proven way to make profits in the current version of the internet. Dropshipping is another business model that does not require direct engagement in operations. The confluence with the metaverse will result in new forms of income in e-commerce.

Other low-effort strategies to generate income include placing ads and recommending products in social media posts. Once the metaverse merges with decentralized social media apps, we’ll see variations of these revenue models adapted to the new internet.

Yet, keep in mind that it requires hard work to live off passive income regardless of what the future may bring.

Author

-

Nagi An is a content writer who is passionate about NFTs, web3, DAOs, and DeFi. She's covers a variety of topics about NFT fundamentals.