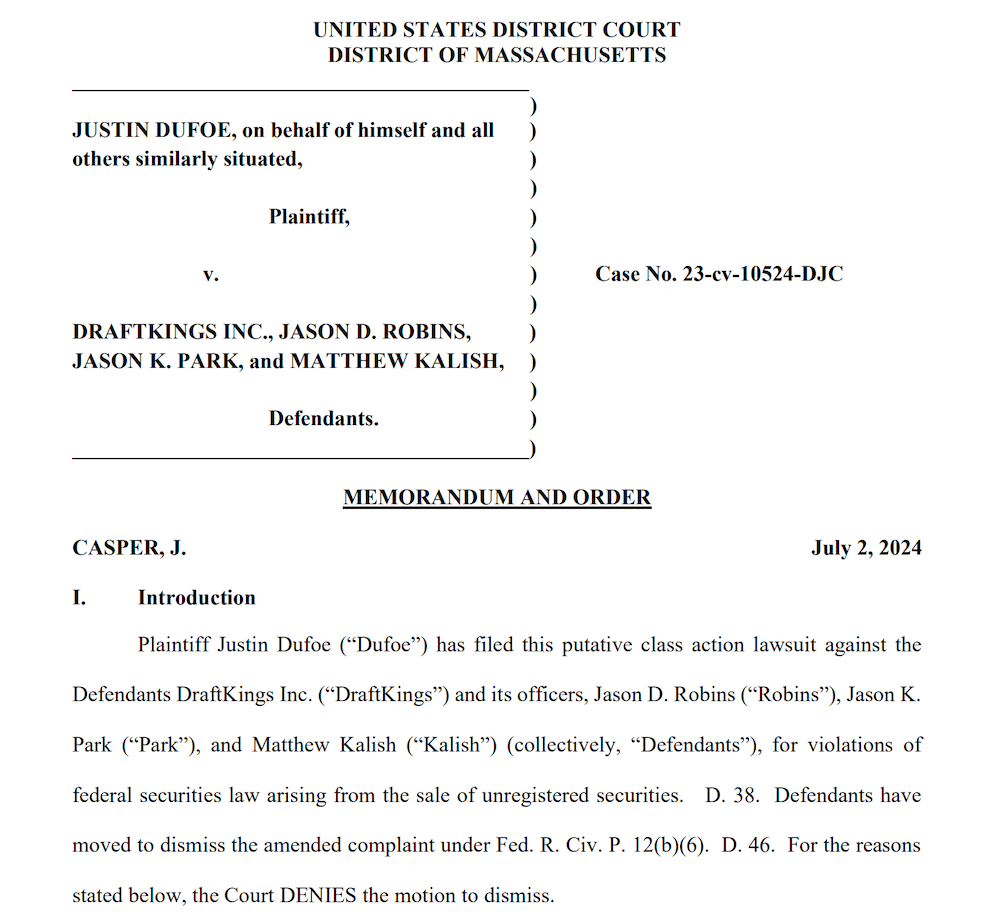

DraftKings, a prominent online sportsbook operator, is embroiled in legal challenges, including the Draft Kings NFT lawsuit. A recent ruling by a US District Judge in Massachusetts denied DraftKings’ motion to dismiss a class action lawsuit concerning its NFTs. This decision could have far-reaching implications for the classification and regulation of NFTs.

Details of the DraftKings NFT Lawsuit

The class action lawsuit, initiated by Justin Dufoe in March 2023, accuses DraftKings of violating federal securities laws with its NFTs. Dufoe contends that the sports-themed NFTs offered on the Polygon blockchain through the DraftKings Marketplace qualify as investment contracts under the Howey Test.

The Howey Test, established by the 1946 Supreme Court case SEC v. W.J. Howey Co., sets four criteria to determine if an asset is a security: the investment of money, expectation of profits, common enterprise, and reliance on the efforts of others for success. The lawsuit claims that federal law should regulate the NFTs as securities.

US District Judge Denise Casper ruled that the plaintiffs sufficiently met the Howey Test criteria. The court found that the NFTs involved an investment of money pooled into a common enterprise, with a reasonable expectation of profits from DraftKings’ promotional efforts. This aligns with the horizontal commonality aspect of the Howey Test, where multiple investors share in the profits and risks.

The plaintiffs plausibly alleged that the NFTs meet the criteria for investment contracts. The case involves allegations under the Securities Act of 1933.

Legal and Business Implications under Federal Securities Laws

This ruling sets the stage for a landmark legal battle over whether NFTs should be classified as securities. Digital assets research highlights the financial significance of NFTs to companies like DraftKings. If upheld, this classification would impose significant regulatory requirements on DraftKings and similar platforms.

DraftKings is already being compared to other cases, such as the 2023 ruling against Dapper Labs, in which NBA Top Shot NFTs were deemed securities, resulting in a $4 million penalty.

Moreover, the Securities and Exchange Commission (SEC) has been actively targeting NFT issuers, exemplified by the $1.5 million in fines levied against two companies in 2023 for selling unregistered securities. Should DraftKings’ NFTs be classified similarly, it could lead to substantial financial and operational repercussions for the company.

The revenue generated by the sale of NFTs was reinvested into DraftKings’s business. The company’s efforts to maintain investor interest were vital in driving capital appreciation for the NFTs. The case also involves allegations under the Securities Exchange Act of 1934.

The ongoing legal uncertainty surrounding NFTs and their classification under securities law continues to be a significant issue.

Conclusion on Unregistered Securities

Overall, the ongoing legal proceedings against DraftKings highlight NFT regulation’s complex and evolving nature. The outcome of the court battle could set a significant precedent for classifying NFTs as securities.

For DraftKings, the stakes are high, with the potential to reshape its investments in NFT technology and impact the broader NFT market. The industry will be closely watching this case, which may define the future legal landscape for digital assets.

Author

-

Immersive tech enthusiast, diving into the NFT currents reshaping the Metaverse.