How do Fractional NFTs Work?

Discover how fractional NFTs let investors share ownership of digital assets, boosting liquidity, accessibility, and innovation in NFT markets.

Fractional NFTs make high-value digital ownership accessible by dividing a single NFT into smaller, tradeable shares. As tokenized assets gain momentum in 2025, fractionalization is reshaping NFT markets, enabling collective investment, deeper liquidity, and a closer link between digital art, DeFi, and regulation.

Key Takeaways

Fractional NFTs divide ownership of a single digital asset into fungible tokens.

Shared ownership increases accessibility and liquidity for collectors and investors.

Platforms use smart contracts to manage vaults and buyouts.

Legal recognition remains uncertain, with some tokens potentially classed as securities.

The rise of AI analytics and DeFi integration is expanding the utility of fractional NFTs.

What Are Fractional NFTs?

Definition and Purpose

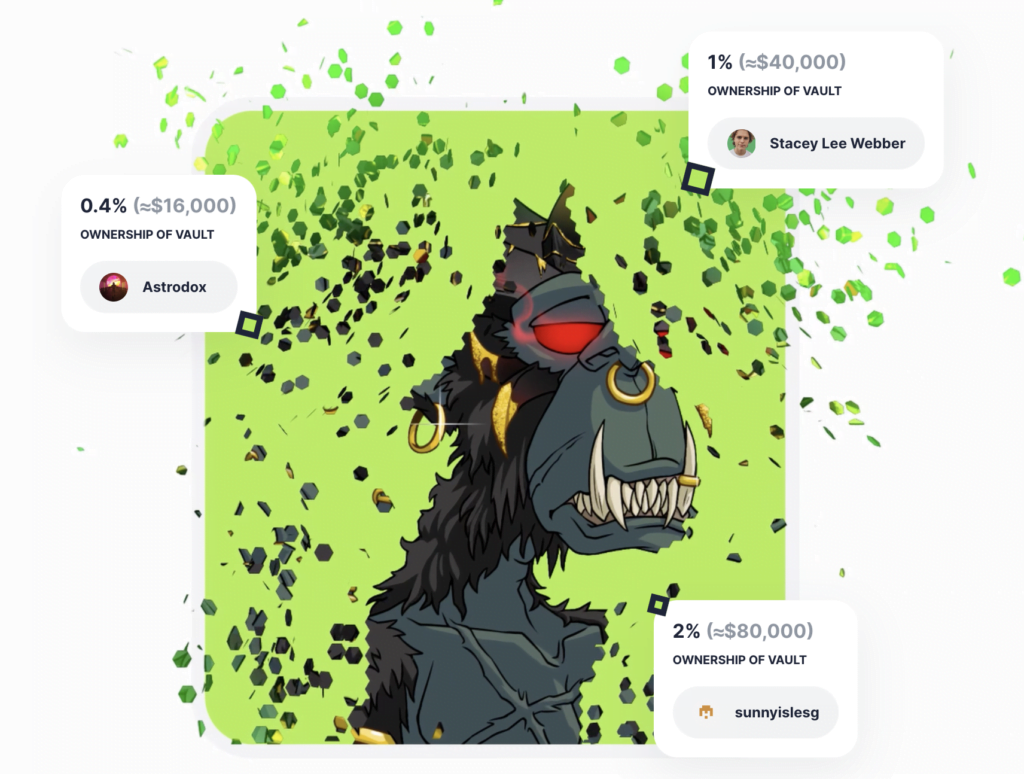

A fractional NFT represents shared ownership in one digital asset, whether it’s a piece of digital art, a collectible, or tokenized media. The underlying NFT is stored in a smart contract, and the contract issues fungible tokens that correspond to ownership shares.

Fractionalization allows multiple investors to hold portions of high-value NFTs, increasing participation in an asset class previously limited to large buyers.

How Do Fractional NFTs Work?

The process typically follows these steps:

The NFT is deposited into a smart-contract vault.

The vault mints ERC-20 tokens representing proportional ownership.

These tokens are traded or staked on supported platforms.

A buyout mechanism may allow full acquisition if bids meet the set reserve price.

This mechanism converts illiquid digital assets into divisible, tradeable units — a major step toward more fluid NFT markets.

Credit: Fractional.art

Credit: Fractional.art

Can NFTs Be Split Into Parts?

Yes. Fractionalization divides ownership rights, not the visual or functional asset itself. The NFT remains intact while tokenized fractions are distributed among investors.

The Mechanics of Fractional Ownership

How Are NFTs Divided Among Investors?

Ownership is determined by the number of fractional tokens held. Token holders may receive governance rights, voting privileges, or revenue shares depending on the vault design. Transparency is achieved through on-chain data visible to all participants.

How Is Ownership Verified?

Smart contracts record token balances and vault activity on public ledgers. This immutable data confirms each investor’s stake and the overall distribution of ownership.

How Are Profits Shared?

When a buyout occurs or the NFT is resold, proceeds are distributed automatically to token holders in proportion to their shares. Some projects extend this to royalty income or staking rewards.

How to Invest in Fractional NFTs

Investment Process

Investing in fractional NFTs generally involves:

Connecting a compatible wallet (e.g., MetaMask).

Selecting a vault or collection on a verified platform.

Reviewing supply, fees, and governance rules.

Purchasing fractional tokens using accepted cryptocurrencies.

Monitoring token value and liquidity across marketplaces.

Popular Platforms

Notable platforms include:

Fractional.art: Focuses on vault creation and governance.

Rally: Specializes in cultural and collectible assets.

Each platform offers different governance frameworks, buyout rules, and fee models.

Resale and Liquidity

Fractional tokens trade on decentralized exchanges and marketplaces. Liquidity depends on demand and vault popularity — blue-chip NFTs typically attract active markets, while niche assets may see limited trading.

Benefits and Risks of Fractional NFTs

Key Benefits

Accessibility: Enables small-scale participation in premium NFTs.

Liquidity: Facilitates faster, smaller trades instead of single-buyer sales.

Diversification: Allows investors to spread exposure across multiple assets.

Community Engagement: Encourages collective ownership and governance.

Innovation: Connects NFTs with DeFi, staking, and DAO governance.

Main Risks

Smart Contract Vulnerability: Coding flaws can compromise funds.

Governance Conflicts: Disagreement among token holders can block decisions.

Regulatory Uncertainty: Classification as securities remains a possibility.

Low Liquidity: Thin trading volumes can make exits difficult.

Balanced risk assessment and platform research remain essential before participating.

Legal and Regulatory Considerations

Are Fractional NFTs Considered Securities?

Regulatory bodies such as the SEC and FCA evaluate fractional NFTs under securities frameworks. Tokens that represent investment intent or profit expectation may qualify as regulated assets.

Are Fractional NFTs Legal?

Legal status depends on jurisdiction and design. Some platforms restrict participation by geography or register offerings to comply with financial rules. Projects that emphasize utility or community use may face fewer regulatory hurdles.

Transparency in structure, disclosures, and governance is a strong indicator of long-term compliance.

Real-World Use Cases and Platforms

Prominent Examples

PleasrDAO’s Doge NFT: Fractionalized into $DOG tokens, enabling thousands of participants to co-own an iconic meme asset.

Unicly Collections: Combined multiple NFTs into curated vaults with governance tokens.

Rally Platform: Offered fractional access to cultural artifacts and collectibles.

Supported Blockchains

Ethereum remains the core infrastructure due to its token standards and liquidity depth. Layer-2 networks such as Arbitrum, Base, and Polygon extend these capabilities by reducing transaction costs and increasing accessibility.

The Future of Fractional NFTs

Are Fractional NFTs the Future of NFT Investing?

Fractionalization is expected to remain a major force in digital investing. Broader participation, improved liquidity, and integration with DeFi suggest a maturing ecosystem rather than a short-term trend.

How AI and DeFi Could Shape the Market

AI-driven analytics are beginning to price fractional tokens dynamically using rarity, transaction history, and market sentiment. DeFi protocols are integrating fractions as collateral for lending and liquidity pools, linking NFT ownership with on-chain finance.

These trends point to a convergence between digital collectibles, financial infrastructure, and data-driven markets.

Frequently Asked Questions

Here are some frequently asked questions about this topic:

What is a fractional NFT?

A fractional NFT divides one NFT into fungible tokens that represent partial ownership, allowing several investors to share an asset.

How do fractional NFTs work?

A smart contract holds the NFT in a vault and mints tokens representing ownership shares, which can be traded or redeemed.

Are fractional NFTs legal?

Legality depends on jurisdiction and structure. Some may fall under securities laws if they involve profit-sharing.

Can fractional NFTs be resold?

Yes. Fractions are traded on supported decentralized exchanges and NFT platforms, subject to liquidity conditions.

What risks do fractional NFTs carry?

Smart contract bugs, low liquidity, and evolving regulation are the main risks investors should assess.