Amid endless speculation about “the death of NFTs”, DappRadar’s NFT report has revealed that NFT sales are still on the rise with Immutable X rising in prominence.

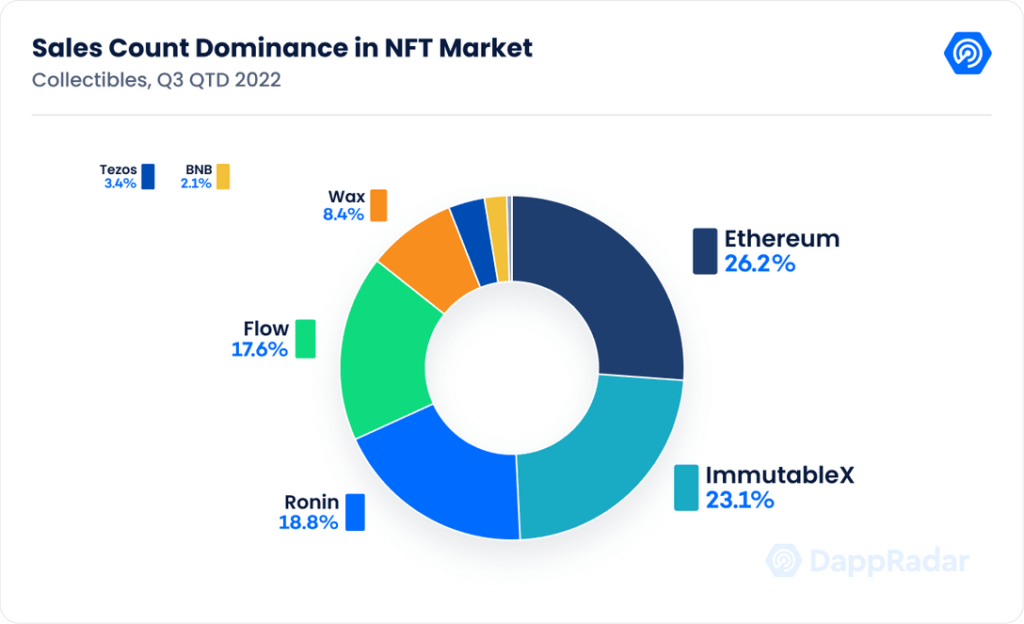

In fact, while Ethereum still leads the way with 26.2% of the total NFT sales, Immutable X – its layer 2 solution – has captured 23.1% of the NFT sales in Q3.

Despite a plummeting trading volume in Q3, which has decreased by 75% from the previous quarter, the number of sales are estimated to reach 21.1 million by the end of Q3 – an increase of 6% from Q2.

Furthermore, the report revealed that the number of unique NFT traders has increased by 36%, compared to Q3 2021.

Thus, the NFT market is still growing and has abundant potential, but a rapidly decreasing amount of money is being traded on NFTs at present.

The report concluded: “Taking into consideration the amount of brands that are starting to implement NFTs and the number of unique traders of this quarter (2.2 million), the expansion of the NFT market will continue expanding also in 2023, but the road ahead will be rocky.”

Ethereum and Immutable X

One thing is for certain, DappRadar’s analytics illustrate the emerging NFT force that is Immutable X.

The layer 2 Ethereum solution has increased its NFT trading volume by 87% from the previous quarter.

Immutable X is an NFT gaming-focused platform and according to the analytics, the potential of Web3 gaming remains extremely bullish.

By contrast on Ethereum, the market cap for its top 100 NFT projects suffered a 44% ($19 billion) decrease in USD value from the previous quarter. Although over the same period, the market cap in terms of ETH based NFTs as a whole decreased only 27% (12.2 million ETH).

However, one significant NFT purchase on Ethereum was made by Deepak Thapliyal, the CEO of Chain, who bought CryptoPunk #5822 for a record-breaking 8,000 ETH (approximately $23.7 million). This sale was the biggest CryptoPunks NFT purchase in history.

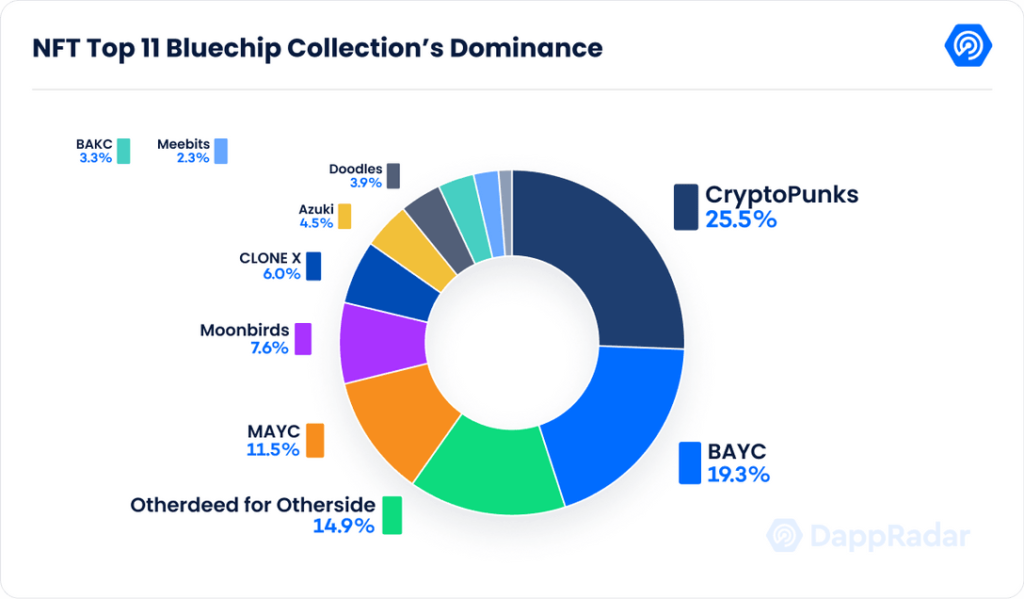

Bluechip collectibles

Interestingly, the DappRadar report found that the floor price of blue chip collectibles are maintaining the same value, despite the trading volume decreasing by 88% in Q3.

Indeed, the floor prices have increased in several of the top blue chip projects, such as Azuki, which increased by 43.18% (11.44 ETH) in September, and Cool Cats, which increased by 15.83% (2.78 ETH).

On the other hand, the four projects of Yuga Labs, besides Mutant Ape Yacht Club’s increase of 2.14% (14.30 ETH) from August, decreased their floor price. CryptoPunks decreased by 5.19% (63.95 ETH), Bored Ape Yacht Club 7.36% (73 ETH), and Otherdeed just 0.57% compared to August.

Digital art

Digital art remains a market with great promise, and contemporary art institutions are beginning to acquire art produced as NFTs. Moreover, digital art is an important element of the expanding virtual realm labelled ‘the metaverse’. Despite this, in Q3 the overall trade volume has been $58 million, which is a 72% reduction from the previous quarter. The number of sales decreased by 43% over the previous quarter, reaching 258,000.

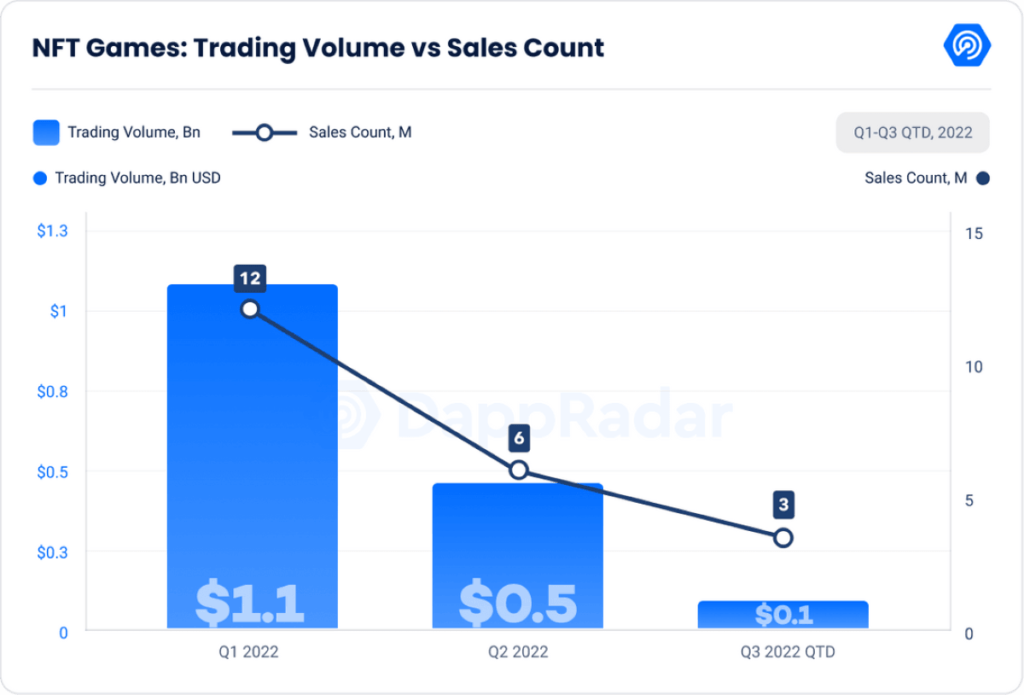

Blockchain gaming NFTs

The blockchain gaming market which is worth more than $8.6 billion, and with 847,000 daily Unique Active Wallets (UAW) registered in August, saw the total trading volume of NFTs decline sharply from $1 billion in Q1 of 2022 to just $71 million in Q3. Additionally, sales numbers fell from 12 million in Q1 to 3.3 million in Q3.

Fashion and luxury NFTs

Despite a drop in trade volume in Q3, fashion and luxury NFTs still have huge potential. A prime example of this was the Tiffany & Co NFT collection, which minted each of its NFTs for 30 ETH ($50,000), and sold out in 20 minutes, netting $12.5 million in revenue.

Sports NFT market

The sports NFT market is currently led by the industry powerhouses Sorare and NBA Top Shot.

In Q3, the total trading volume of both projects combined was more than $18 million, a 61% decrease from the previous quarter. Despite the seemingly bleak financials, the DappRadar report concludes the sports market for NFTs is still strong. Furthermore, Sorare will benefit greatly from the 2022 World Cup, which starts in November.

The impact of The Merge

Finally, DappRadar also weighed in on the famous Merge – Ethereum’s move to proof-of-stake. The global app store for decentralized applications concluded that The Merge, which reduced Ethereum’s energy consumption by 99.95%, was a positive move. The report asserted: “This is a significant advancement for Ethereum blockchain and particularly for NFTs, successfully rebutting one of the most common NFT objections.”

Author

-

Max is a distinguised author with a keen interest in Web3 technology.