In a recent report by DappRadar, a decentralized application (DApp) data aggregator, blockchain gaming and the metaverse have managed to escape the “Lehman Brothers-like” collapse of Terra in May. The report stated that decentralized finance (DeFi) and nonfungible tokens (NFTs) did not fare as well.

The study was released last Friday and likened the implosion of Terra in May 2022 to the 2008 subprime mortgage crisis that plunged the world into one of the worse economic landscapes since the Great Depression. Terra’s collapse saw DeFi, NFTs, and companies like Voyager, 3AC, and Celsius take it on the figurative ‘chin.’

The report said, “It is becoming clear that the Terra debacle has become a Lehman Brothers-like event that has sent shockwaves across the entire breadth of the crypto industry and aftershocks that will affect us for many months.”

DappRadar compared several metrics to indicate how the Terra collapse affected various parts of the crypto world between the first two quarters of the year. The collapse occurred in the middle of quarter 2 (Q2) of 2022.

Gamefi and Metaverse projects dodge the drop

Among the many data the study used to gauge the Terra crash, perhaps the one that loomed the largest was the total number of completed transactions. Known as transaction count, this benchmark gives a good sense of user engagement. DeFi and NFTs saw dips at almost 15% and just over 12%, respectively. Contrasted with the increase of 9.5% for blockchain and 27% for NFT-related metaverse games, it’s clear where the Terra shatter hit the hardest.

Another factor the report delved into was activity from unique active wallets or UAWs. Where NFTs are concerned, action sunk 24% in Q2. Blockchain gaming only dipped 7% using the same metric, to which the report concluded that gamers kept engaging with gaming DApps at a similar level as before the Terra trouble.

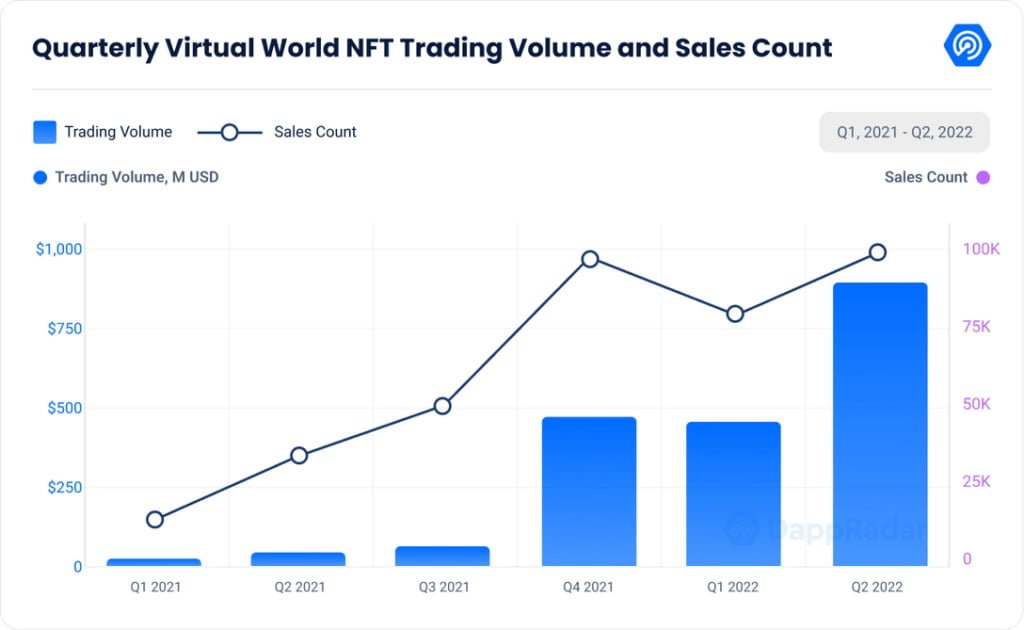

Meanwhile, the volume of trading for metaverse-related NFT schemes was seen as a “beacon of hope,” as numbers increased by a staggering 97% since Q2—the near 33% drop in the overall NFT industry during the same time notwithstanding.

DappRadar submitted an earlier study in July where it concluded that blockchain gaming held on better than other crypto sectors in Q2 because of the non-speculative nature of the games.

“This bullish activity indicates that engagement with the virtual worlds is not predicated on their profitability to the end-user. It shows virtual worlds are intrinsically fun to the end-user as the communities remain active despite the devaluation of native tokens,” the July report stated in part.

Sustained institutional financial support in blockchain and the metaverse also helped keep those areas afloat during the hurricane that struck Terra. This may underscore that top investors believe in the longevity and financial potential of these sectors over some others.

The continued investment during the Terra-quake is evidence of support that remained consistent throughout Q2, according to the report.

“Despite a financial blow and undermined trust in the industry, investors remain bullish as the number of investments into blockchain games and metaverse projects has remained constant quarter-over-quarter, with $2.5 billion invested in both Q1 and Q2.”

Author

-

Paul Cooper is a writer, thinker, teacher, and father. He lives and works in the United States and loves annoying his daughter.