Non-fungible tokens (NFTs) have soared in popularity over the last year, but are they tumbling from their lofty heights? Are NFTs disintegrating before our eyes or are they just getting started?

The NFT market is experiencing a fall from grace, much like the world’s economy. In fact, the two factors are inseparable. When the US Federal Reserve raises interest rates, the world feels the pinch of inflation. Amidst worldwide economic gloom and a war in Ukraine, enthusiasm for NFTs has waned from investors, who are less inclined to speculate on NFT projects. Notwithstanding these testing times, it will be interesting to see which NFT collections survive and thrive in this hugely volatile market.

The truth is, despite all the bad press about NFTs lately, the technology continues to evolve. While profile picture (PFP) NFTs are not all the rage anymore, we’re going to see a new, more sophisticated breed of NFT now, as the technology consolidates. This new breed of NFT is well positioned to transform the way we do business in the future.

Many have declared the death of NFTs while the technology is still in its infancy. According to coinmarketcap.com, the market cap for NFTs is currently around $12 billion, which suggests that there is still a lot of growth to come.

Digital asset downturn

Recently, we’ve seen the value of NFTs crashing in parallel with the plunging cryptocurrency market. Previously obscene NFT price tags, such as the $2.9 million tweet from Twitter co-founder Jack Dorsey, have had a reality check. The buyer of this famous Twitter NFT, Sina Estavi, recently put the NFT up for auction and was offered a top bid of $14,000. Ouch, yes, inflated price tags are starting to adjust to the times.

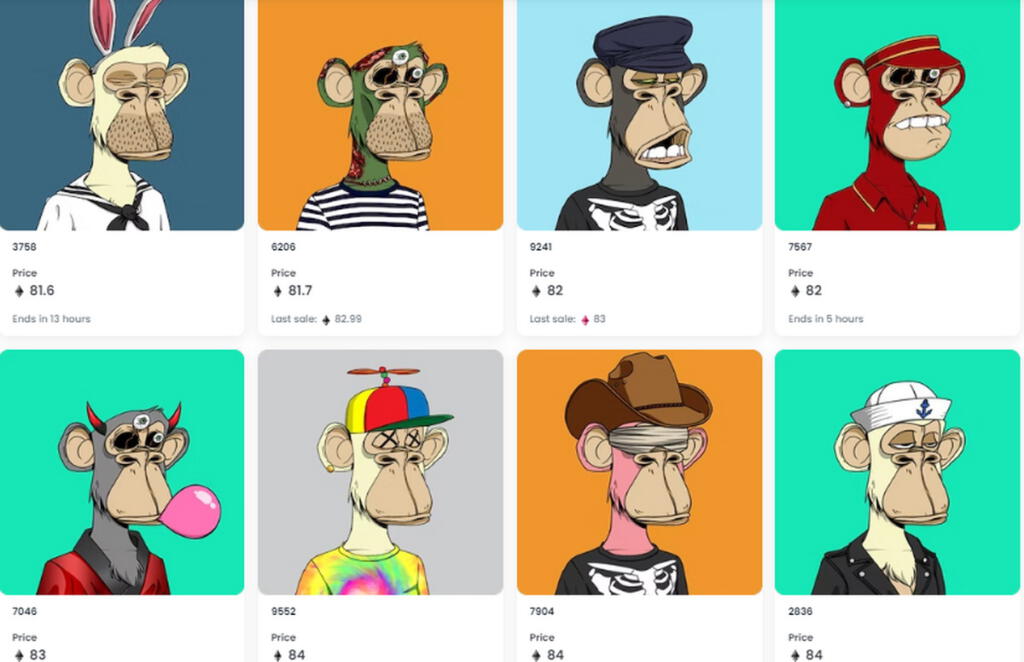

Similarly, holders of the legendary Bored Ape NFTs have seen the value of their NFTs plummet. On the secondary marketplace OpenSea, the floor price for the founding collection by Bored Ape Yacht Club (BAYC) is 91 ETH at the time of writing ($179,715) – down from an all-time high of $276,697. Indeed, Ethereum, the blockchain upon which Bored Apes reside, is down to $1,976 from $4,800 in November last year.

Nevertheless, BAYC is a highly resilient brand and their community is strong. To put things in perspective, Bored Ape NFTs are still being sold for over $200k at the time of writing, which is still a lot of money. This suggests that the Apes are going nowhere and the army of celebrity Bored Ape fanatics, led by pop culture icons like Paris Hilton, will hear nothing of an NFT bubble bursting.

NFTs hold value and longevity

Let’s not forget that in January, just a few months ago, NFT sales were booming and had reached nearly $5 billion on OpenSea. Despite a recent drop of around 50% in secondary market sales, there’s still money being spent on NFTs and in particular, those linked to the metaverse.

In fact, with a global metaverse on the horizon, it could be strongly argued that the best is yet to come for NFTs. Indeed, NFTs will be integral to a thriving metaverse economy and thus, will hold long-term value. As decentralized metaverse platforms emerge, dependent on the buying and selling of digital assets, the technology will be more relevant than ever before.

Furthermore, blockchain games are becoming quite a big thing and guess what they thrive on? Yep, NFTs. If you don’t believe me, just ask Square Enix (SE), owners of the timeless Final Fantasy brand (one of my favourite games of all time). In their quarterly earnings report, SE declared their intent to pursue a future in blockchain technology and specifically NFTs. Having successfully piloted NFTs in one of their games, it looks like they’re investing their future in Web3 and the metaverse.

Moreover, they’re looking to create their own gaming-token on the blockchain and have been working with venture capital firm Animoca Brands, who own The Sandbox metaverse.

There are around 1 million daily active blockchain gamers today, according to DappRadar, which is the same as it was in January. Those gamers aren’t spending as much as they were, but they’re still there and they’re still playing.

Hence, it might be more realistic to say that NFT spending has slowed down from an unsustainable rate during its January peak. What does this all mean for the future of NFTs?

NFT utility and depth

Those on the cusp of launching their own NFT projects would be wise to build utility and depth into their ecosystem.

Buying an NFT needs to mean something and retain value in the long term. It could be that your digital token earns you a vote in the community you adore. Or perhaps, your NFT is your deed for a property in real life (as we’ve already seen in the digital world). Indeed, your NFT could be your own, personal job application profile.

With an irrefutable record of ownership stored on the blockchain, the possibilities for NFT utility are limitless. I believe that, in the next era of NFTs, we’re going to see a far more robust, sustainable form of digital token, which provides integral value to the holder.

An NFT needs to have more than cosmetic value. Owning an NFT should be empowering for the holder, with sustainable, long-term value.

Blockchain education and security

During these early days of NFTs, people need to be educated on what they’re buying and how to avoid phishing scams – an ongoing plague in the space.

Binance have their own dedicated blog, where you can read about all kinds of topics like ‘how to assess the value of an NFT? or ‘how do NFTs impact the environment?’. Informative blogs like this are essential to providing a more resilient, secure future for the blockchain and NFTs.

In terms of security, we’ve seen some high-profile breaches lately, which have rocked the foundations of the blockchain. None more so than the $625 million Axie Infinity heist, which showed that there are exploitable chinks in the blockchain armour. It was a painful lesson for players who lost their assets and the game itself, which has suffered huge losses as a consequence.

Make no mistake, Axie’s developers Sky Mavis learned from the loss and their response has been to tighten-up security on the breached Ronin blockchain.

With a more educated community of blockchain enthusiasts and watertight security on the blockchain, the space will grow more robust and resilient. Breaches are still very rare and as time goes by, cyber criminals will find it increasingly difficult to operate.

Business as usual

In the meantime, it will be fascinating to see how NFTs emerge from the flames of this economically ravaged planet. How will creators adapt their strategy for longevity? It may be a testing time for the blockchain and NFTs, but believe me, behind closed doors, creators are working in overdrive to build meaning and long-term value into their NFT projects.

I believe that we’re not far away from a time where, whether we like it or not, NFTs will be all-pervasive in our lives.

Author

Max is a distinguised author with a keen interest in Web3 technology.