Binance NFT announced today the launch of an innovative NFT Loan feature. This initiative enables platform users to obtain cryptocurrency loans using their NFTs as collateral, effectively unlocking liquidity without the need to sell prized digital assets.

Unlocking Value with NFT-backed Crypto Loans

The new service focuses on prime NFT projects, offering competitive interest rates and eliminating gas fees, thus facilitating users to borrow Ethereum (ETH) against their NFTs. The move introduces the benefits of Decentralized Finance (DeFi) to the Binance NFT community, enhancing the flexibility and utility of digital assets.

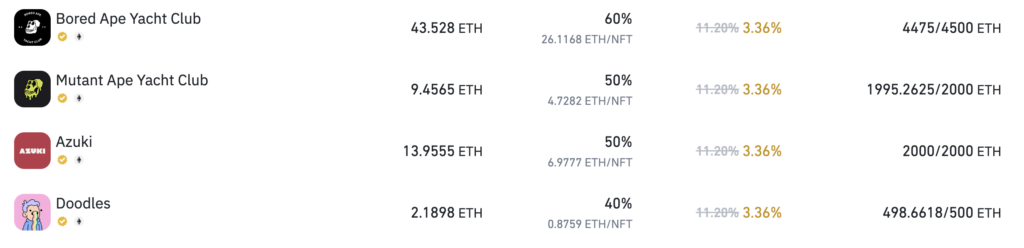

Users can currently secure loans against famous NFT collections such as Bored Ape Yacht Club (BAYC), Mutant Ape Yacht Club (MAYC), Azuki, and Doodles. Binance NFT anticipates incorporating more collections soon, further expanding the service’s reach and appeal.

“Binance NFT is building!” declared the Head of Product at Binance, Mayur Kamat. “With the addition of a host of features, we are striving to become the go-to platform for NFT trading and financial services. We not only offer low fees and the security of Binance but now also provide NFT Loans, a new form of liquidity for NFT holders. This enables them to engage in the market without parting with their valued NFTs.”

Binance NFT: A One-Stop-Shop for NFT Financial Services

Binance NFT provides a trustworthy platform that brings together artists, creators, NFT enthusiasts, collectors, and fans of creativity from around the globe. Offering a vast array of collectibles, Binance NFT extends easy access to its extensive user base of over 90 million individuals.

The loan feature targets those who possess NFTs but may require quick access to funds. It provides a convenient solution with competitive interest rates via a ‘Peer to Pool’ approach. Binance NFT serves as the pool for loans, ensuring additional security for its users.

The quantum of ETH that can be borrowed is contingent upon the NFT collection’s floor price. This is determined based on Binance’s Oracle Pricing, an amalgamation of data from multiple sources, including Chainlink and OpenSea. With this strategy, Binance NFT continues to innovate and create comprehensive solutions tailored to the evolving digital asset landscape.

By facilitating the borrowing of crypto, particularly ETH, using renowned NFT collections as collateral, Binance is offering a nifty liquidity solution for NFT holders.

Author

Web3 advocate with a knack for breaking down complex concepts into engaging narratives.