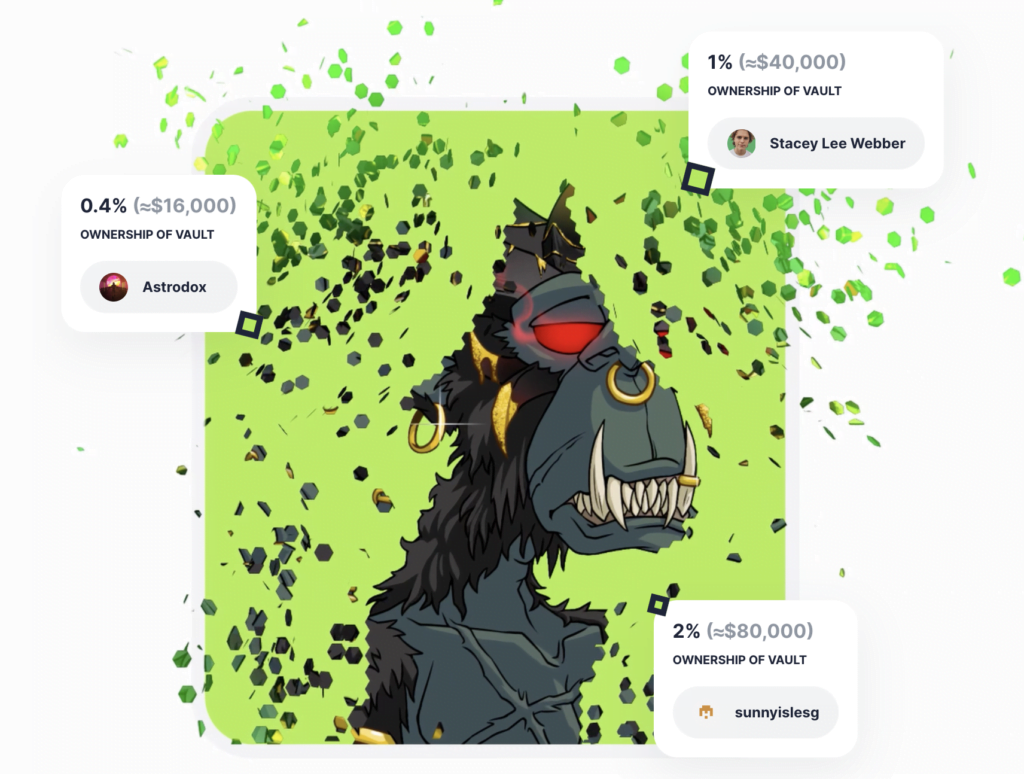

A fractional NFT is obtained by splitting a single NFT asset into smaller pieces. Fractionalization allows partial ownership of an NFT. In this way, investors who don’t have the means to buy the total asset can receive a share of it. The process works akin to purchasing shares of blue-chip stocks. That’s why applications of fractional NFTs make sense, especially in the case of high-value assets like real estate, fine art, luxury goods, and all sorts of rare items.

How to create fractional NFTs?

We can create fractional NFTs on any blockchain capable of running smart contracts and deploying nonfungible token formats. Ethereum is the most widespread blockchain, so let’s see how the process works on it.

- As a first step, you mint an original single asset as an NFT in an ERC-721 format. It’s possible to use ERC-1155 as well, though it’s less common.

- Then, you lock the asset in a smart contract so that nobody can transfer it.

- Next, define parameters like the number of total fractions, each fraction’s price, and other information to be included in the metadata.

- The code splits the original ERC-721 asset into a predefined number of fractional tokens as ERC-20, which are interchangeable tokens like cryptocurrencies. As a result, each represents an equivalent share of the original NFT.

- You can then sell or transfer the newly created ERC-20 tokens to others, enabling partial ownership of the original asset.

Use cases of fractional NFTs

Although it’s a relatively new concept, some web3 platforms, protocols, DAOs, and other NFT-related dapps have already adopted fractional NFTs.

Fractional.art, for example, enables minting your own NFT as fractional NFTs, as well as buying and selling NFTs from historical collections as fractions. The platform hosts one of the most iconic NFTs of all time: the Doge. This unique digital asset was acquired by PleasrDAO, a well-known collective investment DAO, in 2021 for $4M via an NFT auction. PleasrDAO later fractionalized it into 16,969,696,969 pieces which you can buy on Fractional.art. At the time of writing, the valuation of the whole asset is around $11.8M, and there’re over 10K unique owners.

Not just for fine art

Another fractional NFT platform is Otis. In addition to art, it hosts other collectibles, such as sneakers and rare books. Some prominent examples of fractional NFTs hosted on Otis include Chromie Squiggle #2241, an asset from the very first project by the generative art platform Artblocks, the Jordan 1 Metallic Red sneaker, and the first edition, the first printing of Harry Potter and the Philosopher’s Stone.

Real estate is another domain where the fractionization of assets can be helpful. Vesta Equity, a home equity marketplace, allows homeowners to tokenize their properties and investors to build a portfolio of residential equity, all thanks to the fractional NFTs that run on the Algorand blockchain.

The wine and spirits industry is also among the early adopters. For instance, UniCask fractionalizes premium whisky casks as NFTs. The first UniCask collection issued a 1991 vintage cask of a high-value single-malt Scotch whisky. Another beverage-related platform leveraging fractional NFTs is Crurated which releases curated NFT drops from fractional barrels of fine wine.

A remedy to the NFT liquidity problem

Another critical function of fractionalizing NFTs is to provide liquidity to an otherwise illiquid market because it’s much easier to sell or buy small units of expensive assets. Consequently, the NFT asset class becomes more accessible, and more participants mean better liquidity.

Moreover, new ways of mitigating the illiquidity of NFTs via fractional counterparts are emerging. On Unicly, it’s possible to convert NFTs into fractional ERC-20 tokens called uTokens and provide liquidity on the protocol’s DEX by locking them.

How to retrieve the original NFT?

It’s theoretically possible to reverse the fractionalization process and retrieve the original single NFT. To this end, you can add a “buyout” option to the smart contract that created the individual fractions in the first place. This allows any owner of the fractional NFTs to buy all of the other existing fractions and unlock the original single NFT.

Yes, it’s theoretically possible to retrieve the original NFT by including a “buyout” option in the initial smart contract. This allows any owner of the fractional NFTs to buy all other existing fractions and unlock the original NFT.

Fractionalizing NFTs can improve market liquidity by making it easier to buy or sell small parts of expensive assets. This makes the NFT asset class more accessible, and with more participants, liquidity improves.

A fractional NFT is created through a process involving minting an original asset as an NFT, locking it in a smart contract, defining parameters like the total number of fractions, and splitting the original NFT into ERC-20 tokens, which can then be sold or transferred.

A fractional NFT is a part of a single nonfungible token (NFT) that has been split into smaller, more manageable parts. It allows for partial ownership, making it accessible to those who may not have the means to purchase an entire NFT.

Fractional NFTs have been adopted by several platforms, protocols, DAOs, and other NFT-related apps like Fractional.art and Otis. They’ve been used for a wide range of assets, including fine art, collectibles, real estate, and even premium whiskey casks and fine wines.

Author

Nagi An is a content writer who is passionate about NFTs, web3, DAOs, and DeFi. She's covers a variety of topics about NFT fundamentals.