Top Stories

Discover Binance Megadrop: the innovative token-launch platform that offers users unique opportunities to earn rewards through airdrops and Web3 quests.

Shibtoshi discusses his debut, opening 'the gates to a digital empire', privacy in blockchain, the future of NFTs and more.

- Latest News

Discover Binance Megadrop: the innovative token-launch platform that offers users unique opportunities to earn rewards through airdrops and Web3 quests.

Explore the future of gaming with the integration of blockchain technology. Discover how NFTs in Playstation and Xbox games will drive web3 gaming.

Shibtoshi discusses his debut, opening 'the gates to a digital empire', privacy in blockchain, the future of NFTs and more.

Veyond Metaverse integrates Apple Vision Pro into its XR 5D Digital Surgery platform, revolutionizing anatomy education and remote surgeries.

Discover Binance Megadrop: the innovative token-launch platform that offers users unique opportunities to earn rewards through airdrops and Web3 quests.

Explore the future of gaming with the integration of blockchain technology. Discover how NFTs in Playstation and Xbox games will drive web3 gaming.

Shibtoshi discusses his debut, opening 'the gates to a digital empire', privacy in blockchain, the future of NFTs and more.

Veyond Metaverse integrates Apple Vision Pro into its XR 5D Digital Surgery platform, revolutionizing anatomy education and remote surgeries.

How NFT Integration in Playstation and Xbox Games Will Drive Mainstream Web3 Gaming

Explore the future of gaming with the integration of blockchain technology. Discover how NFTs in Playstation and Xbox games will drive web3 gaming.

Ragnarok: Monster World Set to Launch on Ronin Blockchain in Q3 2024

Experience the new MMORPG sensation with Ragnarok: Monster World, a game that combines tower defense and monster collection elements for an immersive gaming experience.

Faraway Acquires HV-MTL and Legends of the Mara from Yuga Labs

Yuga Labs sells HV-MTL and Legends of the Mara IPs to Faraway, a leading Web3 gaming studio. Learn more about this strategic move and the new points system for NFTs.

Xterio Joins Forces with Forge to Expand Web3 Gaming Reach

Forge partners with Xterio to integrate Web3 games into its platform, enhancing gaming experience with new titles.

Veyond Metaverse Launches XR 5D Digital Surgery with Apple Vision Pro

Veyond Metaverse integrates Apple Vision Pro into its XR 5D Digital Surgery platform, revolutionizing anatomy education and remote surgeries.

Upland Launches “Share & Build” Airdrop Series at NFTNYC

Upland unveils the “Share & Build” airdrop series at NFTNYC, offering unique NFTs and incentives to engage the community.

The Synergy of Fashion and Tech: ALTAVA’s Move into TOZ Universe

Discover how ALTAVA and Play TOZ’s partnership is setting new standards in digital fashion, blending innovation with creativity in the TOZ Universe.

TCG World Partners with SKALE to Transform the Metaverse Experience

Discover how TCG World and SKALE’s partnership is setting a new standard for the metaverse, offering users a limitless digital experience.

Need a passive income source? Earn at least $500 a day with Stakingfarm

Learn how to make passive income online with no money using Stakingfarm. Discover the benefits of staking cryptocurrencies and earning regular income.

Solcraft Ecosystem Preparing to Launch the $SOFT Utility Token on Solana Blockchain

Solcraft, blending Minecraft with Solana, is gearing up to launch its $SOFT token, sparking anticipation with teaser releases on X (Twitter).

extra mile and tv asahi group Launch First Blockchain Games Accelerator

Extra mile and TV Asahi launch Japan’s first blockchain gaming accelerator, offering developers resources, incubation, and marketing support.

W3WC Dubai Event: Where Visionaries Unite for Web3’s Tomorrow

Join us in Dubai for our flagship gathering, where we’ll

HeLa Labs Announced First Incentivized Testnet, Enhancing Blockchain Technology

HeLa Labs, a modular blockchain company that focuses on building a layer 1 ecosystem that aims for a future of seamless integration of decentralization adoption aligned with real-world applications.

Magic Eden Outshines Blur with Record NFT Trading Volume in March

Magic Eden surpasses Blur with record trading volume of $756.5M in March, driven by strategic enhancements and a robust reward program.

Binance NFT Marketplace Ends Support for Bitcoin Ordinals NFTs

End of an era for Bitcoin Ordinals on Binance’s NFT marketplace. Starting April 18, users won’t be able to trade or interact with these unique digital assets. Find out more.

Poopcoin Airdrop to Doodles Community Sparks Market Frenzy

Explore the world of Poopcoin, the crypto project that’s adding value and positivity. Discover how Poopcoin’s airdrop to Doodle NFT holders is creating buzz in the community.

Exploring the Stargaze Marketplace: Unlock the Power of Cosmos

Discover Stargaze marketplace, the premier NFT marketplace on the Cosmos blockchain. Explore a universe of unique digital art and collectibles.

Introducing SuperRare Bitcoin Ordinals Artwork

SuperRare expands to the Bitcoin blockchain, bringing its acclaimed NFT art platform to the world of Bitcoin Ordinals with inscriptions and a new collection.

Investing in Digital Art: Hivemind’s Move into Blockchain Creativity

Hivemind launches the Digital Culture Fund, investing in digital art and embracing the shift towards blockchain-enabled creativity.

Palm Collective Opens the Door for Artists to Showcase at NFT Paris Exhibition

Palm Collective launch contest for artists to exhibit at NFT Paris, offering $500 grants and showcasing winners at THE RÉAUMUR SPACE.

Punk in Residence: A New Chapter in Digital Art by CryptoPunks

CryptPunks’ ‘Punk in Residence’ program partners with artists to forge new digital art and blockchain works, blending culture with cutting-edge technology.

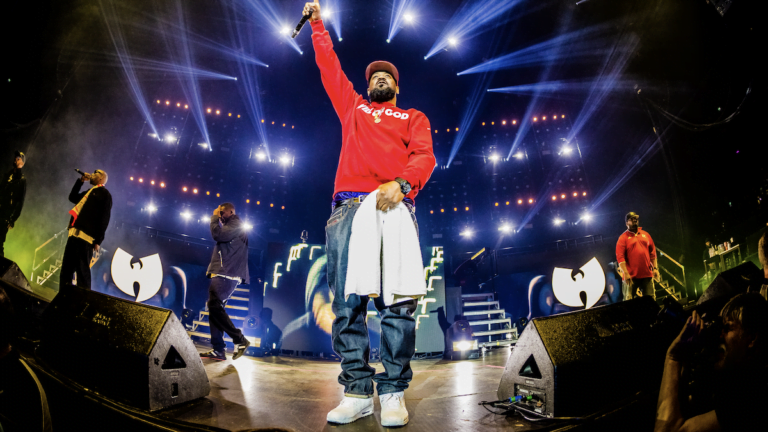

Wu-Tang’s Ghostface Killah to Release Music as Bitcoin Ordinals

Ghostface Killah to release music as Bitcoin Ordinals, offering fans a new way to own tracks with CC0 rights.

Polygon and Warner Music Group Announce Web3 Music Accelerator Recipients

Polygon Labs and Warner Music Group select MITH and Muus Collective as the first recipients of their Web3 Music Accelerator program.

Web3 Music Streaming Platform ‘Tracks’ Expands to LG Smart TVs

Tracks Web3 music streaming dApp, revolutionizes music consumption by launching on LG Smart TVs, offering curated playlists and visuals.

Tune.FM’s Web3 Music Ambitions Fueled by $20 Million LDA Capital Funding

Tune.FM announces a $20 million investment to revolutionize music streaming with its Web3 platform, offering artist compensation and new streaming models.

Binance Unveils Megadrop Platform for Token Launches and Web3 Quests

Discover Binance Megadrop: the innovative token-launch platform that offers users unique opportunities to earn rewards through airdrops and Web3 quests.

Speaking with SquidGrow’s Shibtoshi: “People have lost track of the importance of privacy”

Shibtoshi discusses his debut, opening ‘the gates to a digital empire’, privacy in blockchain, the future of NFTs and more.

Top NFT Exchanges in 2024

Explore the world of NFTs and discover the best NFT exchanges to acquire unique digital assets on the blockchain.

Important PayPal User Protection Policy Update Excludes NFT Transactions

Important update on PayPal’s NFT policy: Starting May 20, 2024, PayPal will no longer cover NFT transactions under its user protection program.

Meta’s Latest Initiative: Bringing VR and AR to the Classroom

Discover the transformative power of Meta’s VR and AR technology in education. Explore immersive 3D learning environments for a more engaging and interactive educational experience.

Exploring The Potential Of NFTs And Real World Assets

Uncover the potential of NFTs in the world of real-world assets. Learn how these digital tokens are transforming ownership and value.

Understanding ERC-998: Composable NFTs on the Ethereum Blockchain

Discover the power of ERC-998: the extension to the ERC-721 standard that revolutionizes NFT ownership structures on Ethereum.

Exploring the Potential of the zkSync NFT Ecosystem

Discover the benefits of zkSync NFTs and how they offer faster and cheaper transactions for non-fungible tokens on Ethereum’s Layer 2 network.